With unparalleled speed, the novel coronavirus (COVID-19) has sown disruption across the global IT supply chain and upended the outlook for data center demand. States are only beginning to open up after restrictions were placed mid-March on every aspect of daily life nationwide, with similar lockdowns imposed elsewhere across the globe.

The debate over easing restrictions is now playing out from statehouse to statehouse as officials weigh the crushing economic impacts of the lockdown against fears of a resurgence in viral spread across the summer and later in the year.

As authorities assess the situation, businesses everywhere are left to process a relentless stream of information. In this article, we review the latest data about the impact of the COVID-19 outbreak on the global IT supply chain and the end demand that supports it.

Stephen Buckler is chief operating officer at Horizon Technology

Supply And Demand

Let’s begin by outlining five areas to watch as the COVID-19 pandemic affects industries and populations at historic rates:

- Supply chain disruption – The pandemic has already required companies to reconfigure their supply chains as part of a broader remapping of global commerce set in train by the trade war between the United States and China that began in the summer of 2018. From the severe restrictions on international travel to unprecedented challenges to staffing, the disruption to the global supply chain will only continue as economists assess the depth of the damage and fresh viral hot spots emerge.

- Impact on demand – The jury is out on how deep the global contraction may go after central banks raced to stave off the threat of economic depression by slashing interest rates and pumping liquidity into the markets. Despite sharply curtailed demand from consumers and enterprises alike, not everything is on a downer: the outlook for cloud-based computing and software-as-a-service (SaaS) remains strong as work from home is now a reality for millions globally and, more than ever, people use video conferencing technology to stay connected.

- Regional differences – It’s not simply that the countries of the world are managing the effects of COVID-19 differently, but the outbreak has impacted the IT supply chain unevenly dependent on the hardware in question: hard drives get manufactured and distributed through a separate supply chain to server components, for example.

- Data growth – An oft-quoted study from IDC / Seagate, released at the end of 2018, predicted an explosion in annualized data generation to an eye-watering 175 zettabytes by 2025. Will the effect of the coronavirus dent these lofty projections and, if so, to what extent?

- Managing uncertainty – If there’s one thing sure about the remainder of 2020 and beyond, it is uncertainty. The IT supply chain will need to adapt to a volatile situation and its aftereffects for a long time to come.

Let’s dive into each of these areas and assess the latest state of knowledge as COVID-19 places unparalleled strain on communities and sectors worldwide.

Supply Chain Disruption

It remains impossible to quantify, even this far into the outbreak, the ultimate impact of the pandemic on the IT supply chain.

In Asia, a semblance of normality has returned to the region. Compare this to February when staffing levels in China were running at 56% of normal, according to a survey at the time from the Institute for Supply Management (ISM).

As China moved frantically to bring the crisis under control within its borders, the dramatic shift of the outbreak’s epicenter to Europe and then the United States threw a whole new level of complexity into the equation, wreaking havoc on its way.

The disruption to the movement of goods hit hard. Almost three-quarters of companies reported transportation restrictions related to the coronavirus, according to the following month’s survey from the ISM. A lengthy recovery to normal operations is now the expectation in most quarters.

In a CNBC Global CFO Council survey released back in March, only one quarter of respondents warned it would take at least six months for supply chains to return to normal once the situation comes under control. As we approach the halfway point of the year, that now seems massively optimistic in hindsight.

Although the IT supply chain has largely adjusted to the initial shocks of the pandemic, commentators warn about the ongoing risk of highly regionalized disruptions until an effective vaccine is in widespread distribution. That could take us well into 2021, even beyond.

This may mean the frequent re-imposition of the kind of measures which initially placed the U.S. economy in lockdown in an effort to slow the spread of the virus. But how might this further impact technology firms, already scrambling to meet the demands of the moment?

Consider California, where shelter-in-place orders first announced for the Bay Area in March and soon after extended statewide by Governor Gavin Newsom, imposed tight restrictions on the IT supply chain and required Silicon Valley companies to rethink how they conduct operations.

For the Bay Area at least, there is emerging evidence these early measures helped keep the worst excesses of the coronavirus—notwithstanding the risk of resurgence—at bay. Compare similarly with China, which took aggressive steps to rapidly bring the virus under control. The perhaps uncomfortable lesson for U.S. policymakers is that such a command-and-control approach, combined with high levels of public adherence, works.

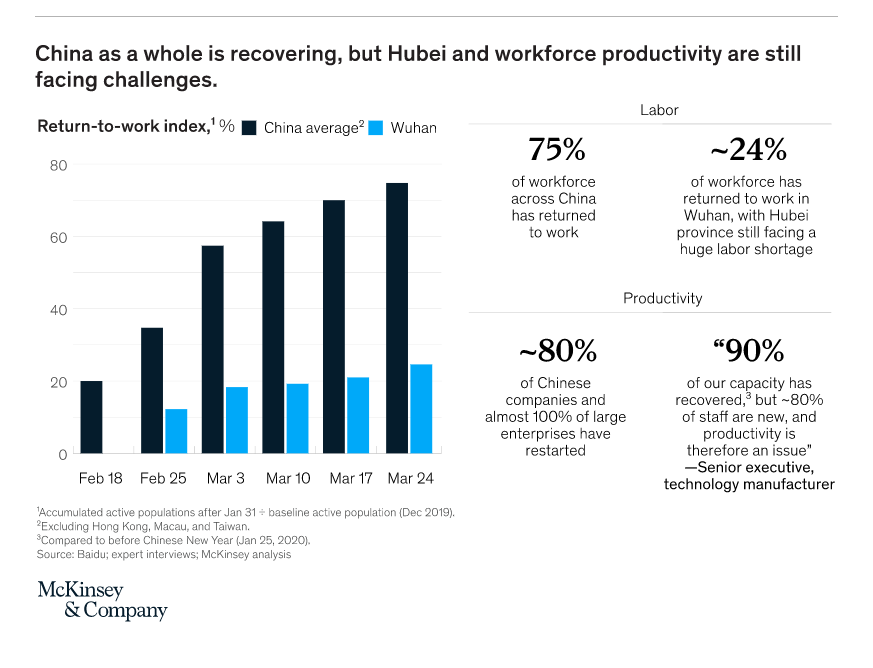

Even with the virus largely under control, there is no glide path to recovery. Reports, for example, that Chinese manufacturing is returning to normal need to be seen within context. Even as the original epicenter of the outbreak, Wuhan, lifted its months-long lockdown on April 8, consulting firm McKinsey cautioned that Hubei province had significant catch-up ahead of it compared with the rest of the Chinese mainland.

It’s important to keep in mind that manufacturing supply is only one part of a complex global equation. Unlike the 2011 floods in Thailand where the extent of the impact on the supply chain was highly localized, it is difficult to untangle production challenges related to COVID-19 from those driven by shifting market dynamics and international logistics.

Take the abrupt suspension of visitor travel into the United States from Europe in March, which injected fresh complication into an already-spooked supply chain: freight forwarders, which routinely rely on commercial flights for the movement of goods, were left racing to devise contingency plans. Unsurprisingly, the reduction in commercial flights fast spiked prices, with air freight rates increasing fourfold (and beyond in some cases), while sea and domestic LTL rates saw slight increases.

Building resilience will require tech companies to invest in two interconnected, longer-term supply-chain realignments: managing supply-chain-footprint risk while increasing supply-chain-planning agility.

Advice from McKinsey to companies looking to future-proof supply chains against comparable global shocks.

There’s also the indirect impact on business operations. We continue to hear reports of disruption to credit and payment cycles, giving both suppliers and customers headaches. Upended demand forecasts combined with supply chain breakdowns are making business planning decisions difficult.

At the same time, there is firm evidence that the hardware supply chain has broadly held up in key areas over recent months, certainly for the hyperscalers.

In a keynote interview with CNBC at the end of March, Microsoft CEO Satya Nadella expressed confidence that the IT supply chains were already fast coming back. The focus instead was shifting to the impact of the outbreak on global demand and the continued need to protect worker and public safety, he said.

“Right now the [hardware supply chain] is not our biggest issue. Our biggest issue is what happens in the United States, in Europe, and other developed markets around the demand side of this.”

The Outlook for Demand

Which brings us to the demand side. While sales of household essentials and work-from-home equipment remain high, the longer-term impact on demand for tech hardware appears less rosy.

Already, IT analysts are writing off 2020 as the lost year of growth and look to 2021 for recovery. According to a YPO survey of 3,500 CEOs worldwide conducted April 15-19, almost two-thirds (64%) of respondents expected reduced revenues to last for at least the next 12 months; only one in six (16%) predicted a rise in revenues one year out.

The cumulative impact doesn’t make for pretty reading, with industry analyst IDC recently slashing its IT spend forecast to negative 5.1% for 2020.

“Inevitably a major economic recession, in Q2 especially, will translate into some big short-term reductions in IT spending by those companies and industries that are directly impacted,” said IDC’s Stephen Minton.

“Some firms will cut capital spending and others will either delay new projects or seek to cut costs in other ways. But there are also signs that some parts of the IT market may be more resilient to this economic crash in relative terms than previous recessions with technology now more integral to business operations and continuity than at any time in history.”

Spending on devices is expected to fall sharply (down by 12.4%), whereas the outlook for infrastructure spending appears more positive, with a projected annual growth rate of 3.8% buoyed by a sustained uptick in cloud demand. Nonetheless, this still compares with an 8.8% increase in infrastructure spending for last year, indicating across-the-board suppression in growth.

“Where there is growth, most of it is in the cloud,” said Minton. “Overall software spending is now expected to decline as businesses delay new projects and application roll-outs.”

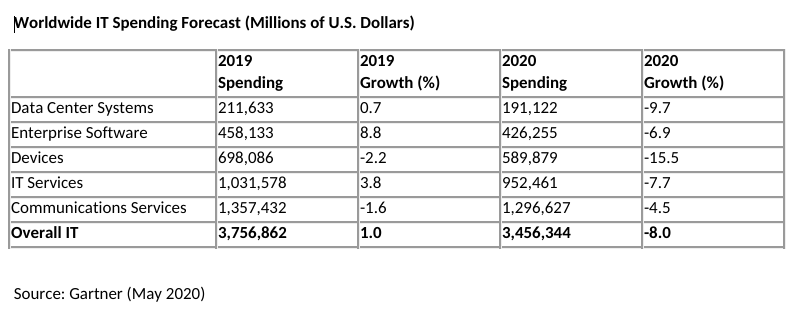

For its part, Gartner projects an even starker contraction in overall IT spending, forecasting an 8% decline in year-on-year expenditure to $3.4 trillion. This level of spending still represents a massive chunk of change, outstripping the annual GDP of most advanced economies even before the pandemic hit.

As with IDC, Gartner foresees the greatest shrinkage in device spending and similarly projects a degree of resilience in cloud investments, though it broadly expects contraction across the board.

Gartner and IDC’s projections align with analysis from Enterprise Technology Research, which anticipates a net 5% reduction in IT spend for 2020. In a tale of two techs, ETR predicts a crop of winners and losers among incumbent suppliers as COVID-19 upends business as usual.

“The market for IT suppliers is notably bifurcated,” according to commentary from Silicon Angle on Enterprise Technology Research’s spending forecast.

“Those suppliers well-positioned have clear cloud plays with software-as-a-service models, work-from-home plays, and modern cloud native stacks. Legacy on-premises vendors appear to be hardest hit.”

It’s true the wind is in the sails for the hyperscalers and select SaaS firms right now. Microsoft, for one, is clearly doing well, despite the longer-run concerns over demand, and its CEO knows it.

THE SKY’S THE LIMIT FOR VIDEO CONFERENCING – Witness the surge in the stock price of video conferencing service Zoom as its user base skyrocketed, prompting its urgent beefing up of platform security. Or Google, which reported a 20% year-on-year increase in businesses paying to use its flagship G Suite. This is alongside a staggering 25-fold increase in daily usage of its video conference solution since the beginning of the year.

Speaking to CNBC at the end of March, Satya Nadella confirmed certain cloud and SaaS services were experiencing unprecedented surges in demand. He pointed to an increase in consumer hardware sales, particularly a spike in work-from-home equipment and healthcare technology kit, as well as a sharp spike in streaming and gaming services.

He also voiced confidence that the cloud infrastructure underpinning a raft of online services remained capable of withstanding the demand surge.

“If there’s a silver lining in any of this, it’s that the current architecture of public cloud and SaaS applications has elasticity built into it,” Nadella remarked. “If this was a previous generation of data center and software architectures, I don’t think we would have been able to deal with this crisis as effectively.”

DIGITAL TRANSFORMATION IN ACTION – Speaking separately to Forbes in May, Nadella highlighted the resilience of hospital infrastructure, the rise of telemedicine, and the rapid shift to online learning amid the coronavirus as examples of digital transformation in action. “These were all long-term forces, but think about the acceleration now. We’ve talked about this for decades, but this is the time we are now doing it at scale.”

Nadella’s assessment appears borne out by additional projections from IDC, which point to a weakening in demand for sales of external enterprise storage systems across 2020 but a slightly less pessimistic outlook for server systems as cloud demand holds up.

Expect year-on-year declines of 5.5% to $28.7 billion for 2020 in sales of external enterprise storage systems, with a return to growth not forecast until the end of the year. Server sales are projected to fall year-on-year by 3.4% to $88.6 billion.

The IT Infrastructure market has two submarkets going in different directions: decreasing demand from enterprise buyers and increasing demand from cloud service providers. This dynamic is impacting the server market the most, resulting in just a moderate decline for the overall market in 2020. The external storage systems market, with a higher share of enterprise buyers, will experience a deeper decline in 2020.

IDC’s quarterly global enterprise tracker

In any analysis, the impact of the global shock on economic activity cannot be underplayed.

In a briefing paper, Christopher Rogers, senior researcher at Panjiva, warns of a “bull-whip effect” as a return to manufacturing supply in China is met by a concurrent slump in demand in those parts of the world currently battling the worst of the pandemic.

Market Fundamentals

It’s not as though the market was in perfect balance before COVID-19 hit. It had already been dealing with a variety of component challenges, including a tightening of the DRAM and NAND (used to assemble SSD) supply and an ongoing Intel shortage. Still, the virus has turned demand on its head and put further stress on an already strained supply chain.

As IDC predicts, the largest negative impact on sales resulting from the virus will likely hit computer and mobile devices. PC sales have been under downward pressure for some time as individuals increasingly give up their desktop computers, instead storing data in the cloud and accessing it through mobile devices.

COVID-19 has only exasperated this downward trend—consumers are widely closing their pocketbooks as huge swaths of the world’s population enter a period of acute financial insecurity and analysts warn of unemployment levels matching in severity those of the Great Depression.

Of course, the quarantines and public shutdowns helped buoy device sales (if only temporarily) as corporations outfitted their employees to work from home. For instance, Micron CEO Sanjay Mehrotra disclosed on an analyst call in late March that the company had purchased in the ballpark of 5,000 notebooks for its employees to use from home.

(On the supply side, the production of smartphones and personal computers was initially impacted due to the high concentration of manufacturing inside the most heavily affected areas within China earlier in the year. As expected, manufacturing in these areas has broadly normalized, according to reports.)

The server market is affected by the COVID-19 situation but to a lesser extent than consumer platforms, as more of the manufacturing resides outside of China. Although server assembly has limited exposure in China, motherboard supply does originate in China—and so this could still prove to be a gating factor in the event of further outbreaks.

However, the server market is far from without its strains—it was already having to traverse a variety of shortages before the coronavirus outbreak. For one, Intel has struggled after a botched transition to 10 nanometer technology. With limited capacity, the chipmaker is choosing to focus on high-end Xeons (62XX Xeons) that yield the greatest profit margins. As a result, low-end Xeons are very tight.

Indeed, wherever we look across the IT supply chain, tightness—together with uncertainty— seems to be the common theme.

- Memory has been very tight with manufacturers having brought supply in line with demand, making it difficult to accommodate upsides. Research house TrendForce worries that a global decline in consumer purchasing power may pose “dire, system-wide risks for the global economy” and trigger an earlier-than-expected slump in the memory market. “Waning purchasing power will lead to lowered demand for electronic products and subsequently impact the demand for upstream memory products,” it states.

- Hyperscaler demand in North America and China has ramped, related to a spike in streaming services as people stay home due to COVID-19. According to the Pew Research Center, the vast majority of U.S. adults (93%) say that “a major interruption to their internet or cellphone service during the outbreak would be a problem in their daily life.”

- The SSD market has similarly been tight, with demand for consumer-based SSD expected to increase 5% and enterprise demand projected to increase 10%. One customer cited Intel as aggressively raising prices with little flexibility. Expect to see price inflation across the board.

Currently hard drive supply remains relatively unaffected, with supply and demand more or less in balance. However, as anxiety and uncertainty persist, we may see end users start to pull in product in advance for fear of being left short.

Also worth noting is that Seagate imposed a coronavirus logistics surcharge on its customers and introduced moderate price increases to account for the rise in costs due to the outbreak.

Hard Times for Hard Drives?

So, what will be the likely impact of the coronavirus on the global supply chain for hard disk drives (HDD)? As we have seen, the IT supply chain is, by its nature, complex and vulnerable to shocks.

With HDD, the manufacturing of drives is horizontally distributed across multiple suppliers and regions. For example, a head assembly for the manufacture of hard drives may be produced in one location and shipped to another location for assembly. From there, the drive is shipped to an alternate location for final configuration and testing.

This movement along the production chain leaves multiple opportunities for disruption.

At the height of the uncertainty in China during February, shortages were being reported in every aspect—from raw materials and finished goods to labor and logistics support. Customers were reporting burning through safety stock, with several hitting the streets looking for stock to support builds.

As mentioned, the situation has broadly normalized in China, although time will tell what the long-term impact on the HDD supply chain will be. Reports of anticipated disruption have so far been mainly piecemeal.

In February, Japanese HDD glass disk maker Hoya said it was considering plans to scale back its production in Vietnam and Thailand in response to expected supply chain disruption related to the coronavirus outbreak. Toshiba was also reported to be suffering pandemic-related disruption, centered on its recertified line.

Additionally, there were rumors in March that Seagate was preparing to temporarily shutter part of its overseas operations in response to the outbreak, although that now seems to be mainly off the table. By most measures, in fact, Seagate is the least affected of the large HDD makers.

On an April 22 analysts call announcing strong revenue growth for the previous quarter, CEO Dave Mosley said the firm’s supply chain was “almost fully recovered” in such places as China, Taiwan, and South Korea and that conditions were improving in other regions. However, he did warn of continued supply chain disruption through the current quarter.

“We are engaging with our suppliers and manufacturing partners on a daily basis, and we’ll continue to take action to mitigate supply risks, including building inventory levels on critical components; supplementing our own supply with external sources where possible: and utilizing external labor resources to support our workforce needs.”

Seagate CEO Dave Mosley talking to analysts on April 22

Generally speaking, we see the more developed nations of Asia in a much stronger position than those of the EU, while EU countries are faring better than the USA from a supply chain perspective.

In fact, we see China and Hong Kong almost fully operational, with some lag among the smaller Asian developing nations where part of the HDD manufacturing takes place. Production in the Philippines is returning to near normal, at approximately 80% of standard capacity.

As supply chain operations continue to normalize out of Asia, we suspect it will take 60 days for supply to catch demand. EU demand has largely been confined to major OEMs that are having supply chains hiccups with HDD delivery. Demand in the USA seems to be more repair-driven and centered around commercial computers. We think this is largely due to the vast proportion of the workforce having to work from home.

Any longer-term disruption to the supply of storage drives will ultimately impact data center builds, though—as always is the case in these situations—consumers will get hit first.

As for Seagate, the data center demand side continues to look healthy. The company’s most recent quarter saw revenue from mass capacity storage increase 68% year-on-year, driven by record sales of nearline products shipping at an average capacity per drive of 4.1 TB.

In its own quarterly analysts call, rival Western Digital expressed similar confidence in the outlook for high-capacity HDD and also pointed to increased logistics and manufacturing costs related to the pandemic.

New CEO David Goeckeler highlighted “healthy demand from our major cloud customers throughout the quarter” amid an accelerated transition to the cloud across all walks of life.

“These trends will continue to drive innovation and data storage growth for a number of years,” he told analysts. “High-capacity hard drives are the foundation to enabling the world’s essential zettabyte scale data infrastructure, providing unmatched capacity and TCO efficiency.”

According to Goeckeler, interest in WD’s new 18TB drives, currently in qualification with a number of customers, is very high. Reports suggest WD may be shipping 18TBs into Google and waterfalling its 16TB drives with other customers across the rest of 2020.

From most angles, the outlook for enterprise hard drives indeed remains healthy, as demand for cost-effective storage in the cloud data center fuels sales. In its latest analysis, IDC predicts year-on-year growth in global storage capacity—what it terms “the Global StorageSphere”—of 16.6% to 6.8 zettabytes (ZB) despite the uncertainties of the pandemic.

“The volume of data stored in the Global StorageSphere is doubling approximately every four years,” said IDC’s John Rydning. “While the COVID-19 pandemic will hamper economic growth and IT spending, it will have little impact on the expansion of the Global StorageSphere as consumers and organizations are likely to extend the useful life of existing storage capacity to keep up with the demand for storing more data, especially near term.”

This bodes well for nearline demand and supports an appetite among the drive makers for price increases. Across the board, nearline pricing is on the rise by up to 5% for Q3 as the OEMs seek to bend the curve on price falls.

It’s not all rosy in the HDD garden, though. Despite the continued strength in nearline, demand for mission-critical HDDs, a smaller slice of the data center pie for the OEMs and long under threat from high-performance SSD, looks to be down by as much as 30%, leading to increased availability.

Uncertain Days Ahead

While it remains difficult to draw definitive conclusions, the massive economic shocks facing countries across the globe is set to have a prolonged effect.

Companies have already accepted the reality of a global recession: the question is how long it will last and how deep it will go. 55% of respondents to the latest survey conducted by PwC of corporate finance leaders in the United States expected their company to experience a decline of 10% or greater on their top and / or bottom line for 2020 as a result of the pandemic.

Today, the spread of the novel coronavirus and the continued threat it poses to public health and the economic situation globally make for massive disruption. We will continue to update our analysis as the situation moves through the rest of 2020.

Find out more about how Horizon can help with the supply and lifecycle management of data center drives and related server hardware in these challenging times.

Related reading: